ADVIA CREDIT UNION

Services we provide:

- Discovery

- Digital Strategy

- Content Analysis

- Custom Integrations

- UX/UI Design

- Website Development

- Hosting

- Support

About Advia Credit Union

Advia Credit Union has a mission to provide financial advantages to its members by providing advice, advocating for members, and offering advantages other financial institutions don’t. This is accomplished through innovative financial solutions and a new, scalable website. For this new site, Advia sought to proactively provide the quickest and easiest digital solution for members to get the best user experience. Advia is not like other financial institutions; this is illustrated in Advia’s commitment to serving the ever-changing financial needs of its members. One of its core values is to drive progress by engaging in a spirit of innovation and developing new digital service tools for its members. This led to an innovative website redesign to give members easy access to information digitally.

The Challenge

The old website was not intuitive, and the overall digital experience lacked. The lending areas of the old site for both mortgages and auto loans were not producing results. With increased in mobile traffic, the site needed an improved mobile user experience. A major challenge facing Advia’s business team was the organization and content hierarchy of the old site. The content was repetitive and text-heavy, and members were confused about where to find the information they sought. Other obstacles included Advia’s team being unable to easily update the content and structure of the pages on the old website.

Goals for the New Site:

- Improved navigation layout

- Measurable enhancements

- Increase time spent on the website

- Meets brand standards with redesign

- Increase overall visitors engagement

- Increase content management efficiency

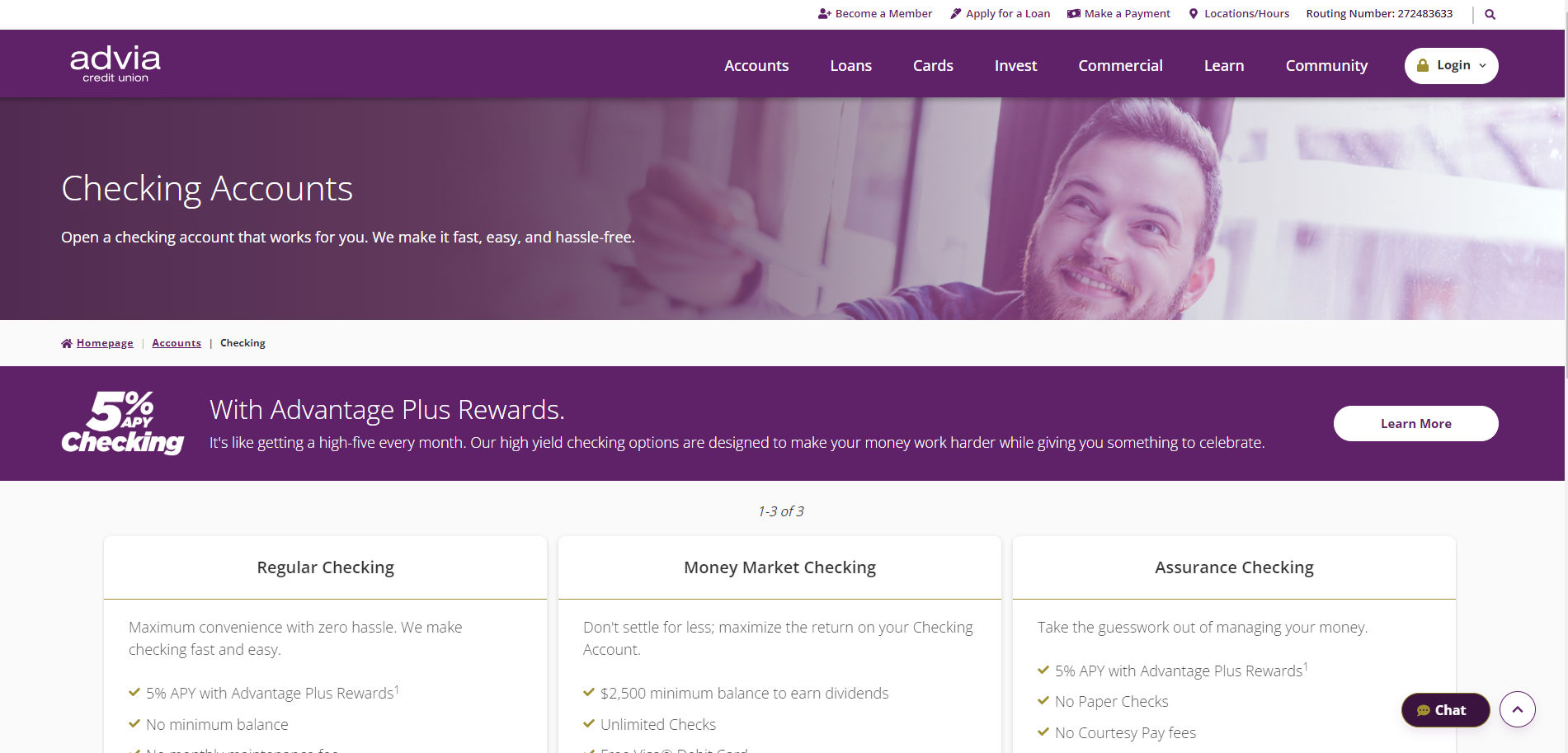

Advia wanted to create a “one-stop” resource center to educate members on digital banking—including forms, links, documents, and video tutorials. Two goals for the new Advia Credit Union website were simplifying content and allowing self-service for members. Advia did not want to reinvent the wheel in terms of UI but wanted to deliver a better digital experience to its members and potential new members. The new website provides a clean and clear navigation experience to eliminate clutter and confusion.

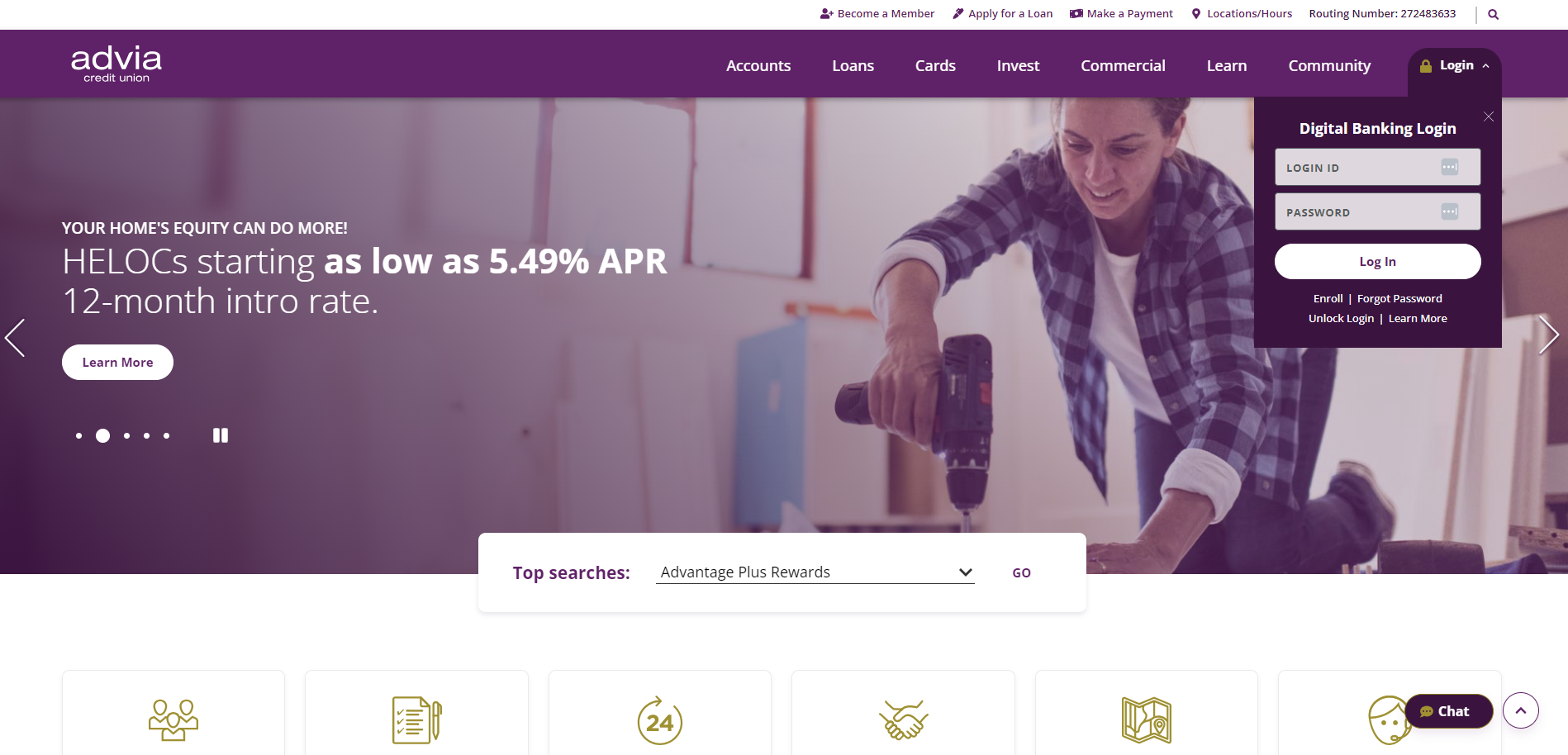

The Right Platform

SilverTech reviewed several CMS/DX platforms with Advia. Progress Sitefinity was the chosen platform, giving Advia a fully optimized digital experience. Using the page templates on the Sitefinity platform allows Advia to accomplish the goals for the new site by enhancing the design and layout of the website with ease. The new website improves the user experience with the use of properly placed navigation buttons and call to actions (CTAs) clearly directing users through the content on the page to the sub-pages. Advia’s site has an engaging navigation and advanced filter functionality allowing users to get to the content they are looking for with ease. Additionally, the Advia content team can seamlessly update and create pages within the Sitefinity CMS, keeping the website current and relevant.

RESULTS

The Rise of Mobile and Online Banking

11/19/24

In the last decade, online banking has transformed from a niche service into a fundamental part of the global financial ecosystem. As smartphones have become ubiquitous, banking institutions have responded by developing innovative mobile applications that allow customers to manage their finances anytime, anywhere. The rise of mobile banking has reshaped the way people interact with their banks and revolutionized financial services worldwide. In a survey by MarketWatch 3 out of 4 people preferred their mobile app or online banking.

Growth Drivers of Mobile and Online Banking

Several factors have contributed to the exponential growth of mobile and online banking, making these the fastest-growing sectors in fintech:

1. Smartphone Penetration:

The rapid adoption of smartphones globally has provided the infrastructure needed for mobile banking to flourish. With smartphones becoming more affordable, even people in remote regions can now access financial services without the need for physical branches.

2. Convenience and Accessibility

The convenience of mobile and online banking is a major driver of its success. Customers can check balances, transfer funds, pay bills, and even apply for loans from their phones or on their computers, eliminating the need for visits to a bank branch. This level of accessibility is especially valuable for people with busy schedules or those living in areas far from banking institutions.

3. Increased Internet Access

Expanding internet access, particularly in developing regions, has further fueled mobile banking. As internet penetration grows, more individuals can access financial services online, contributing to the financial inclusion of previously underserved populations.

4. Digital Transformation of Banks

Financial institutions have embraced digital transformation to meet customer expectations. Banks now offer sophisticated mobile apps with secure features, including biometric authentication, personalized dashboards, and real-time updates. This allows users to manage their accounts with confidence, knowing their data is safe.

Security and Challenges

Despite its advantages, mobile and online banking faces challenges, particularly around cybersecurity. With the rise of digital services comes the risk of fraud, data breaches, and phishing attacks. Banks and fintech companies must invest in robust security measures, such as encryption and Multi-Factor Authentication (MFA), to safeguard customer information and build trust in mobile banking platforms. Banks need a digital partner that is an expert in fintech security.

The Future of Online and Mobile Banking

As technology continues to evolve, the future of mobile and online banking looks promising. With advances in artificial intelligence, machine learning, and blockchain technology, mobile banking apps will become even more personalized, efficient, and secure. Features like AI-driven financial advice, automated savings tools, and digital wallets are likely to become standard offerings in the years to come.

For traditional banks, the focus will likely shift toward creating hybrid experiences that combine the convenience of online banking with the personalized service of in-branch interactions. Furthermore, partnerships between traditional banks and fintech experts will continue to push the boundaries of what mobile and online banking can offer, ensuring that customers have access to cutting-edge financial solutions.

In conclusion, mobile and online banking has rapidly emerged as a powerful force in the financial sector, providing convenience, accessibility, and financial inclusion to millions of people. As technology advances and security measures improve, mobile banking will likely become even more integral to our daily financial lives. With fintech innovation at its core, online banking is reshaping the future of finance. However, as with any technological revolution, it’s essential to navigate the challenges carefully to ensure that mobile banking remains secure, inclusive, and accessible to all. Need expert guidance for your banking website and fintech strategies, contact us to learn more.