Community West Bank

Services we provide:

- Discovery

- Strategy

- UX/UI design

- Website development

- Xperience by Kentico implementation

About Community West Bank

CWB is a large community bank in southern California with over 20+ locations and a track record of financial strength, security and stability gained over its 44 years in business. CWB has set itself apart from other banks by its people, dedication to client advocacy, exemplary "relationship banking," strong community support and a mission to exceed expectations. With a passion for providing customized solutions, the merger drove the decision to revamp their digital services to better serve their customers.

The Process

In an era where digital presence is critical to financial institutions and mergers are frequent, the successful merger of Community West Bank (CWB) and Central Valley Bank (CVB) depended on a robust and well-executed digital strategy, critical to providing a seamless user experience for customers and employees. SilverTech, leveraging its expertise in Xperience by Kentico website development, customized a digital solution that unified the brands of these two banks into one cohesive user-friendly digital experience in just 4 months from start to launch.

The Challenges

The merger of CWB and CVB presented unique challenges, particularly in integrating two distinct digital landscapes into a single cohesive website. The biggest challenges included:

- Differing Content Strategies: CWB's site was optimized for SEO with a rich content library, while CVB's site focused more on detailed product pages. Balancing these different content approaches was crucial.

- Short Timeline: The project needed to be completed with a demanding timeline, delivering a high-quality, functional website, from planning to launch in less than four months.

- Outdated Technology: The old CWB site suffered from poor mobile optimization, slow speeds, outdated information, and a lack of interactive features. This hindered customer engagement and usability.

Goals for New Site

SilverTech identified four main goals for CWB's new website with the main goal of unifying the brands. The merger of the two banks presented a unique opportunity to take advantage of the best from both brands.

Solution and Implementation

Based on the insight gained, SilverTech devised a comprehensive strategy roadmap to address the challenges and deliver a seamless digital experience for the bank merger. It was SilverTech's recommendation that Kentico's newest hybrid CMS platform Xperience by Kentico would be the best solution for the new website. Xperience with robust features and functionality allowed SilverTech to create an exceptional digital user experience efficiently for CWB.

The Key components of the solution include:

- Unified Content Strategy: SilverTech developed a content migration plan that combined the SEO-rich content from CWB with the detailed product information from CVB. This approach ensured that the new site would benefit from both banks' strengths while avoiding duplication and inconsistencies.

- Modern Design and Functionality: The new website was built with Xperience by Kentico, featuring a modern, responsive design to enhance user experience across all devices. Key features included:

- Enhanced Interactivity: Interactive elements and engaging content to improve customer interaction and retention

- Improved CTAs: Clear, strategically placed CTAs to guide users through the site effectively

- Technical Upgrades: Faster loading speeds, improved reliability, and mobile optimization to ensure a smooth user experience

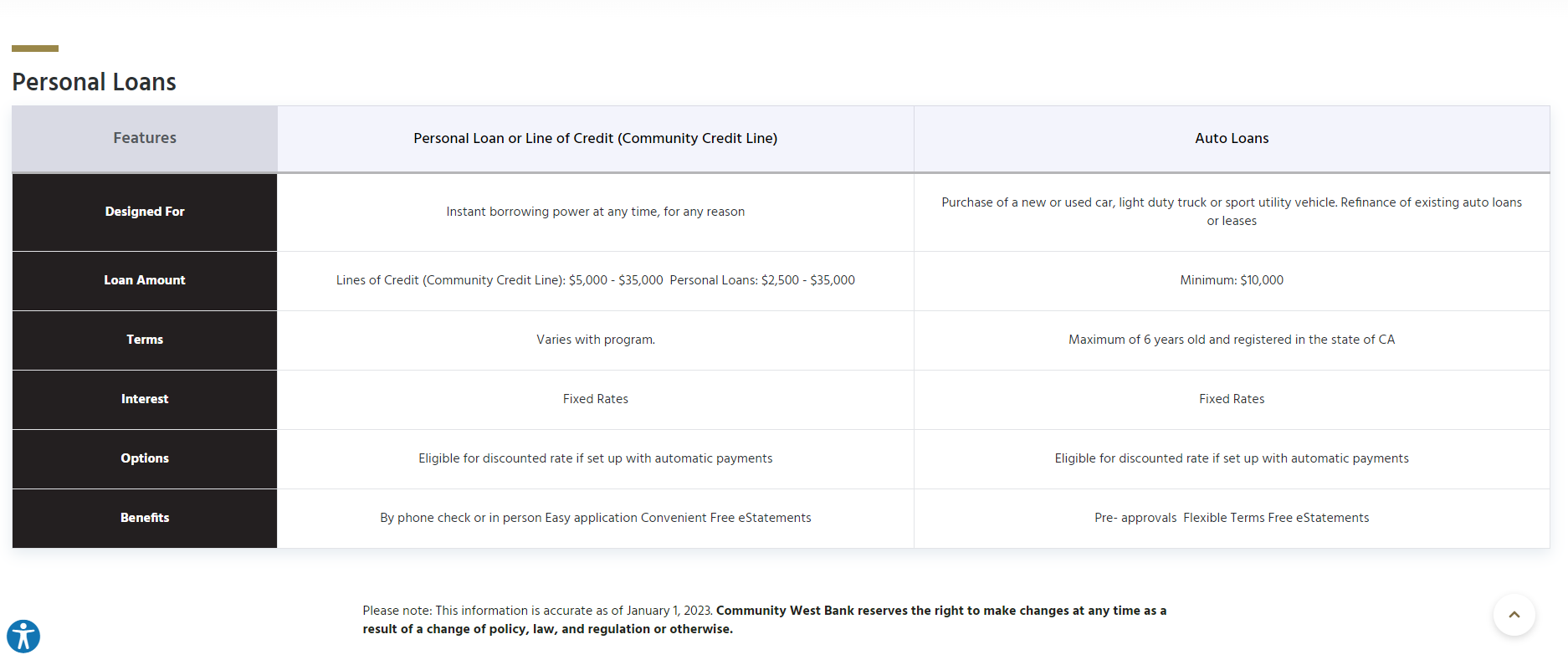

- New Functionalities: Inclusion of essential tools like product comparison tools, branch locator and more

- Accelerated Development Timeline: Despite the tight timeline, SilverTech employed agile development practices to ensure timely delivery without compromising quality. The team worked in sprints to continuously test and refine the site, leading up to a successful launch within the four-month timeframe.

HIGHLIGHTS

Data Privacy Laws Update: January 2025

By: Paul Creme | 2/11/25

Starting this year, about twenty states already have, or will soon, adopt privacy laws similar to California's.

California adopted its privacy law statute in 2018, which was modeled to a degree upon the EU-GDPR regulation adopted by the European Union, also in 2018. Since then, California has amended the law, and it is now known as the California Privacy Rights Act (the “CPRA”).

The following states have chosen to adopt some form of a privacy statute or regulation including Colorado, Connecticut, Delaware, Indiana, Iowa, Kentucky, Maryland, Minnesota, Montana, Nebraska, New Hampshire, New Jersey, Oregon, Rhode Island, Tennessee, Texas, Utah, and Virgina. It is likely that others will soon follow.

Given the considerable number of states that have chosen to codify rights to privacy in personal data, it makes sense for your business to review your company’s website with your counsel to confirm it is fully compliant.

Although each state has slightly different rules and effective dates, most states have made the law effective as of January 1, 2025. While certain states have grace periods, it is best practice to review your website’s privacy policies as soon as possible.

Companies often reference the EU-GDPR and California statute specifically. If your company does business across state lines, state specific language may not be appropriate. Also, while you may believe that you do not have to worry about crossing state lines, remember it is more than likely that a consumer from another state may access your website, and thus, the law in their state would apply. Given the wide range of states, this possibility is exceedingly high.

Pro-Active Steps You Should Consider Implementing

- Determine what state laws, if any, apply to your business. This may be appropriate if you are very state centric, but a better approach may be to be more general in your approach and reflect this language on your website.

- Identify and categorize your processed personal data to understand your obligations. It may differ from state to state, so be sure to work with your attorney to make sure you are in compliance with the most stringent data retention requirements and be sure website users always have the right to be forgotten. Ensure your privacy policies are transparent and reflect the new legal requirements.

- Strengthen your internal data protection practices to safeguard consumer information. Review service provider agreements with vendors that process personal information on behalf of your business. Don't forget, if your company uses third parties to process information, ensure they follow the same data procedures regarding the data they process.

- Be prepared to comply with requests from consumers concerning privacy rights. This includes rights to opt-out of sale or deletion and return of personal information. It is crucial to educate your staff about the new laws and their roles in maintaining compliance.

We cannot provide specific legal advice regarding the wording that may be most appropriate for your company, but we can assist you in making website changes your company deems as necessary. This could include content updates, content integration with data privacy, and content management tools.

Reach out to contact your account manager with any questions.