Community West Bank

Services we provide:

- Discovery

- Strategy

- UX/UI design

- Website development

- Xperience by Kentico implementation

About Community West Bank

CWB is a large community bank in southern California with over 20+ locations and a track record of financial strength, security and stability gained over its 44 years in business. CWB has set itself apart from other banks by its people, dedication to client advocacy, exemplary "relationship banking," strong community support and a mission to exceed expectations. With a passion for providing customized solutions, the merger drove the decision to revamp their digital services to better serve their customers.

The Process

In an era where digital presence is critical to financial institutions and mergers are frequent, the successful merger of Community West Bank (CWB) and Central Valley Bank (CVB) depended on a robust and well-executed digital strategy, critical to providing a seamless user experience for customers and employees. SilverTech, leveraging its expertise in Xperience by Kentico website development, customized a digital solution that unified the brands of these two banks into one cohesive user-friendly digital experience in just 4 months from start to launch.

The Challenges

The merger of CWB and CVB presented unique challenges, particularly in integrating two distinct digital landscapes into a single cohesive website. The biggest challenges included:

- Differing Content Strategies: CWB's site was optimized for SEO with a rich content library, while CVB's site focused more on detailed product pages. Balancing these different content approaches was crucial.

- Short Timeline: The project needed to be completed with a demanding timeline, delivering a high-quality, functional website, from planning to launch in less than four months.

- Outdated Technology: The old CWB site suffered from poor mobile optimization, slow speeds, outdated information, and a lack of interactive features. This hindered customer engagement and usability.

Goals for New Site

SilverTech identified four main goals for CWB's new website with the main goal of unifying the brands. The merger of the two banks presented a unique opportunity to take advantage of the best from both brands.

Solution and Implementation

Based on the insight gained, SilverTech devised a comprehensive strategy roadmap to address the challenges and deliver a seamless digital experience for the bank merger. It was SilverTech's recommendation that Kentico's newest hybrid CMS platform Xperience by Kentico would be the best solution for the new website. Xperience with robust features and functionality allowed SilverTech to create an exceptional digital user experience efficiently for CWB.

The Key components of the solution include:

- Unified Content Strategy: SilverTech developed a content migration plan that combined the SEO-rich content from CWB with the detailed product information from CVB. This approach ensured that the new site would benefit from both banks' strengths while avoiding duplication and inconsistencies.

- Modern Design and Functionality: The new website was built with Xperience by Kentico, featuring a modern, responsive design to enhance user experience across all devices. Key features included:

- Enhanced Interactivity: Interactive elements and engaging content to improve customer interaction and retention

- Improved CTAs: Clear, strategically placed CTAs to guide users through the site effectively

- Technical Upgrades: Faster loading speeds, improved reliability, and mobile optimization to ensure a smooth user experience

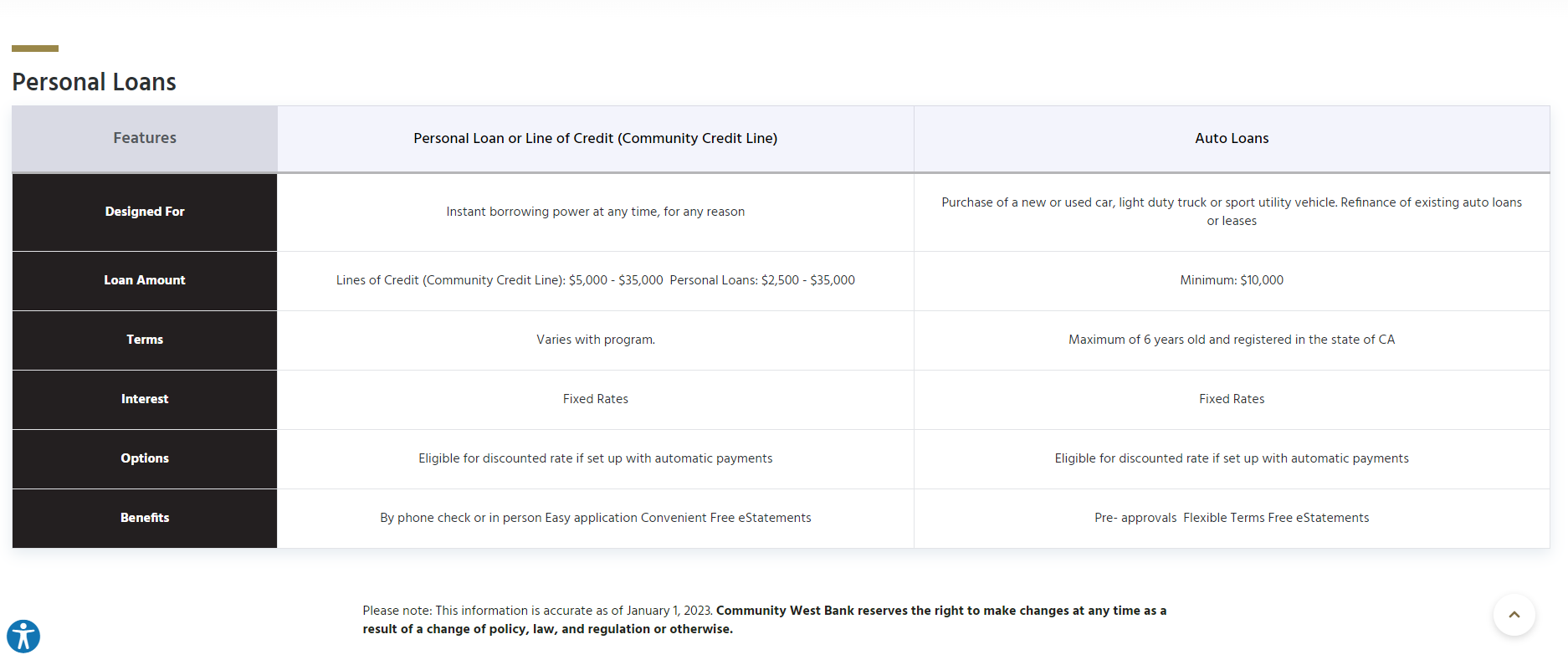

- New Functionalities: Inclusion of essential tools like product comparison tools, branch locator and more

- Accelerated Development Timeline: Despite the tight timeline, SilverTech employed agile development practices to ensure timely delivery without compromising quality. The team worked in sprints to continuously test and refine the site, leading up to a successful launch within the four-month timeframe.

HIGHLIGHTS

What Senior Marketing Leaders Should Care About in 2025

1/7/25

As we step into 2025, the stakes for senior marketing leaders have never been higher. For most in midmarket companies across banking, healthcare, energy, consumer goods and even government, the pressure to do more with less, manage increasingly complex tools, and deliver deeply personalized customer experiences is redefining the marketing playbook. Here’s what should be on your radar to ensure you’re not just keeping up but leading the charge.

Mastering Efficiency Without Compromising Impact

Budgets are tighter, and every dollar counts. The mantra for 2025 is simple: efficiency meets impact. This means leveraging fewer tools but using them to their fullest potential. The technology stack you’ve invested in should work as a cohesive unit, not as fragmented silos. Consolidate where possible and prioritize platforms that offer interoperability and actionable insights.

For example, integrating your CRM with marketing automation and/or both with your website CMS or analytics tools can unlock synergies that amplify your efforts. Less time toggling between systems means more time focusing on strategy and storytelling—the parts of marketing that drive real value.

Personalization: The Currency of Customer Loyalty

Today’s customers expect more than transactional relationships. Whether they’re banking clients, patients, energy consumers, or constituents, they demand interactions and online self-service capabilities tailored to their needs. But personalization doesn’t have to break the bank. Start small—use the data you already have to create segmented email campaigns, localized content, or predictive product recommendations. Then, once you've tested the waters, you can begin to leverage your website CMS platform or an external AI personalization platform to drive personalization across their entire web and digital experience.

AI and machine learning are no longer just buzzwords; they’re practical tools that can make personalization scalable. From chatbots that remember user preferences to dynamic website content, the possibilities are numerous - and it isn't as costly as you might think. The key is to prioritize relevance and authenticity in every touchpoint.

Retention and Acquisition: The Twin Engines of Growth

Retention is your growth multiplier. A loyal customer base not only sustains revenue but also powers your new business engine. In 2025, focus on retention by investing in customer success programs, proactive communication, and ongoing value delivery. Don’t wait for churn signals- anticipate needs and solve problems before they arise.

Simultaneously, your acquisition strategy should be a well-oiled machine, fueled by data-driven campaigns and innovative thinking. Combining these two forces—fired-up retention efforts and a streamlined new-business engine—is the recipe for sustainable growth in a volatile, fast-changing market.

The Path Forward

Marketing in 2025 isn’t about doing everything; it’s about doing things well and having access to the right resources - those that will help your team fill in the gaps and bring value.

Remember, the sooner you start, the sooner you will feel relief and see results.

Top Areas of Focus for 2025:

1. Efficiency: Consolidate your tools and processes for maximum ROI.

2. Personalization: Meet customers where they are with tailored, data-driven experiences.

3. Retention + Acquisition: Balance nurturing existing customers with attracting new ones for exponential growth.

As senior marketing leaders, our role is to navigate complexity with clarity, aligning our teams and strategies to deliver measurable outcomes. By leaning into these priorities, we can turn today’s challenges into tomorrow’s opportunities.

Let’s make 2025 the year we redefine what’s possible in marketing. The future is bright—and it’s ours to shape.

Categories:

Marketing