SENTINEL

Services we provide:

- Discovery

- Strategy

- UX/UI design

- Website development

- Kentico implementation

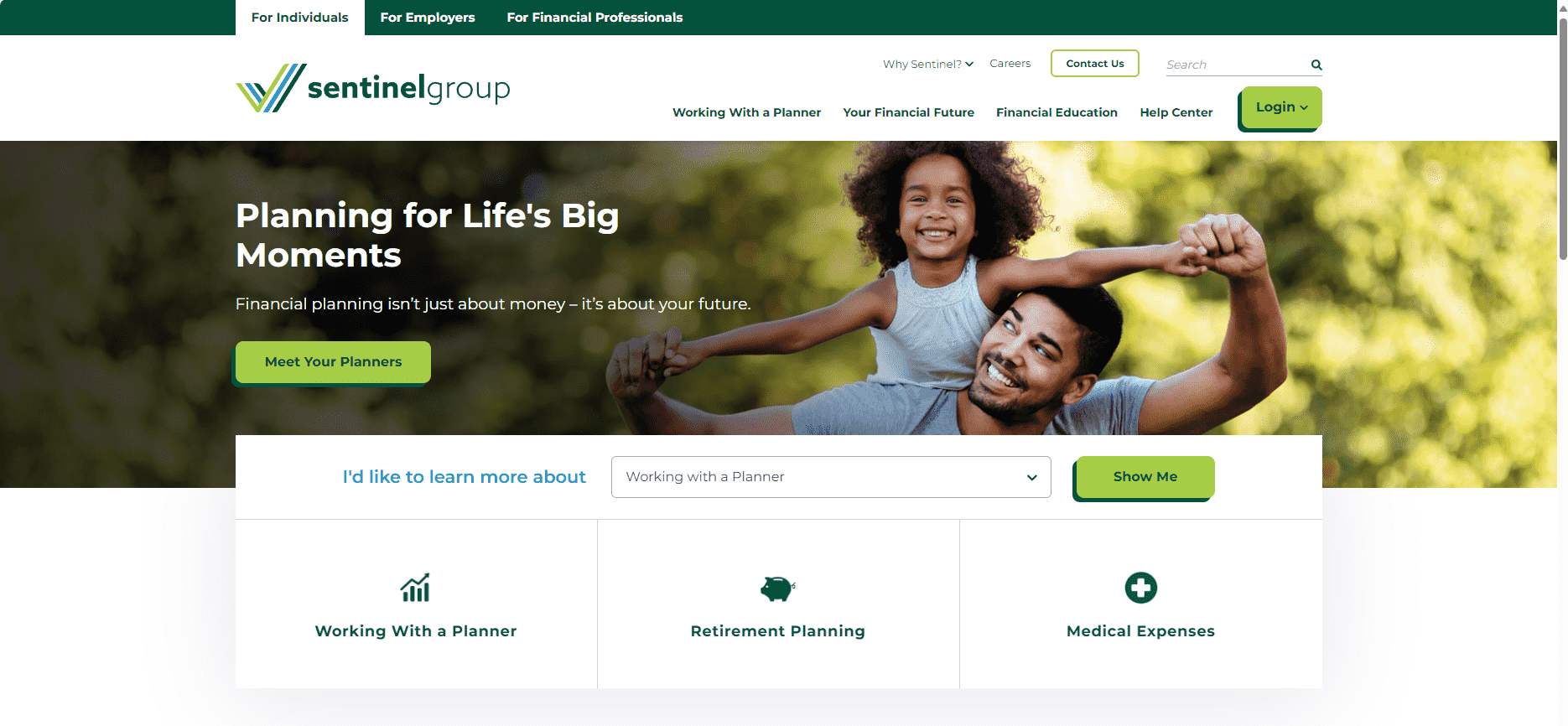

About Sentinel

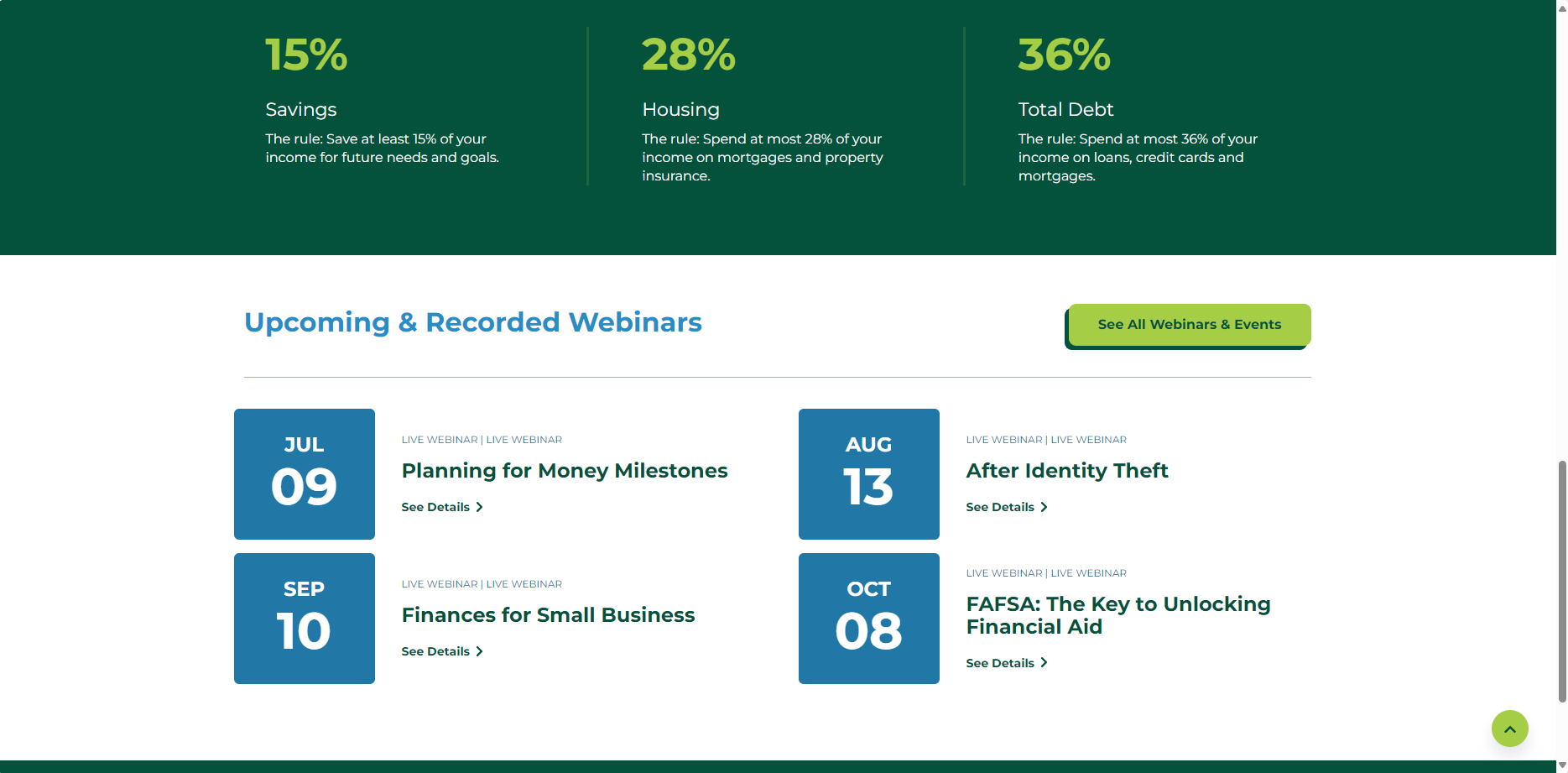

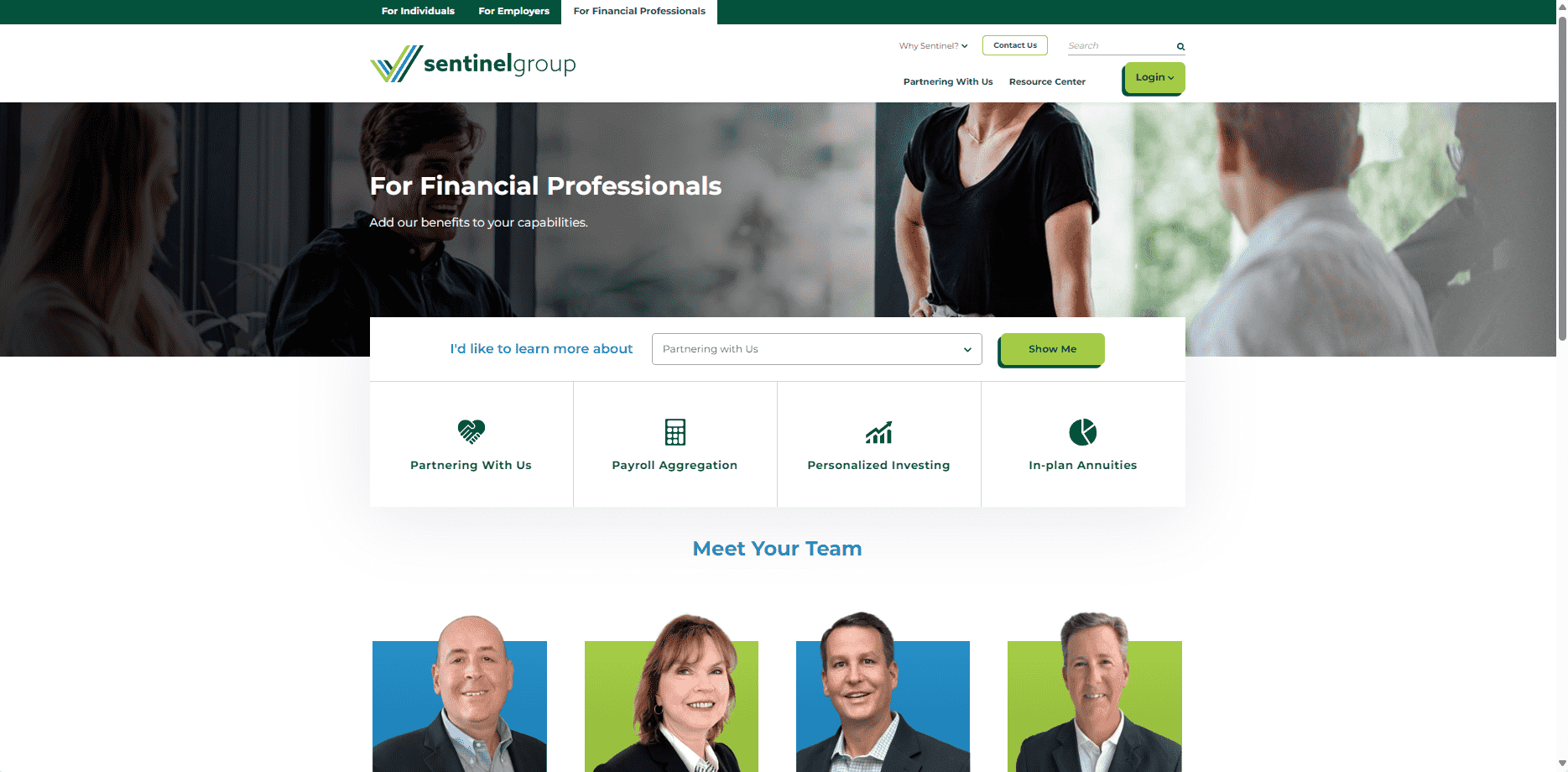

Sentinel is one of the largest employee benefits providers in the Northeast with 4,000+ clients and more than 250,000 plan participants. Sentinel partnered with SilverTech for their website redesign to accentuate their competitive advantages to other providers and strengthen brand messaging and company culture online. Additionally, they wanted to highlight Sentinel as a one-stop-shop benefits provider for employers and employees. Sentinel sought SilverTech’s expertise to create an experience geared towards the individual including storytelling elements through iconography, lifestyle-type imagery, and testimonials on their website.

The Process

Sentinel chose SilverTech’s recommendation of Kentico for several reasons. What appealed most to them was the easy-to-use interface for content editors, the ability to tag content clearly and effectively for multiple user groups, varied ability levels/place in the sales funnel, and the platform’s marketing automation abilities. Since the main goal of this website redesign was to create lead generation, the power and customizable functionality of the Kentico CMS coupled with the easy-to-use personalization and marketing automation features was a no brainer for Sentinel.

The Challenges

SilverTech faced several challenges throughout working on this project. One of the pains of Sentinel’s old site was that the homepage was difficult to use, asking users to act before understanding who Sentinel is. The new website clearly communicates the Sentinel brand before asking users to act. Another challenge that SilverTech faced was placing educational materials and related resources in a location and manner on the website that would be the most beneficial to users. This would make it easy for users to find information on their own and eliminate the need for Sentinel to send users direct links to the information. Sentinel loves the new website and SilverTech was able to address all the challenges of the old website.

RESULTS

The Rise of Mobile and Online Banking

11/19/24

In the last decade, online banking has transformed from a niche service into a fundamental part of the global financial ecosystem. As smartphones have become ubiquitous, banking institutions have responded by developing innovative mobile applications that allow customers to manage their finances anytime, anywhere. The rise of mobile banking has reshaped the way people interact with their banks and revolutionized financial services worldwide. In a survey by MarketWatch 3 out of 4 people preferred their mobile app or online banking.

Growth Drivers of Mobile and Online Banking

Several factors have contributed to the exponential growth of mobile and online banking, making these the fastest-growing sectors in fintech:

1. Smartphone Penetration:

The rapid adoption of smartphones globally has provided the infrastructure needed for mobile banking to flourish. With smartphones becoming more affordable, even people in remote regions can now access financial services without the need for physical branches.

2. Convenience and Accessibility

The convenience of mobile and online banking is a major driver of its success. Customers can check balances, transfer funds, pay bills, and even apply for loans from their phones or on their computers, eliminating the need for visits to a bank branch. This level of accessibility is especially valuable for people with busy schedules or those living in areas far from banking institutions.

3. Increased Internet Access

Expanding internet access, particularly in developing regions, has further fueled mobile banking. As internet penetration grows, more individuals can access financial services online, contributing to the financial inclusion of previously underserved populations.

4. Digital Transformation of Banks

Financial institutions have embraced digital transformation to meet customer expectations. Banks now offer sophisticated mobile apps with secure features, including biometric authentication, personalized dashboards, and real-time updates. This allows users to manage their accounts with confidence, knowing their data is safe.

Security and Challenges

Despite its advantages, mobile and online banking faces challenges, particularly around cybersecurity. With the rise of digital services comes the risk of fraud, data breaches, and phishing attacks. Banks and fintech companies must invest in robust security measures, such as encryption and Multi-Factor Authentication (MFA), to safeguard customer information and build trust in mobile banking platforms. Banks need a digital partner that is an expert in fintech security.

The Future of Online and Mobile Banking

As technology continues to evolve, the future of mobile and online banking looks promising. With advances in artificial intelligence, machine learning, and blockchain technology, mobile banking apps will become even more personalized, efficient, and secure. Features like AI-driven financial advice, automated savings tools, and digital wallets are likely to become standard offerings in the years to come.

For traditional banks, the focus will likely shift toward creating hybrid experiences that combine the convenience of online banking with the personalized service of in-branch interactions. Furthermore, partnerships between traditional banks and fintech experts will continue to push the boundaries of what mobile and online banking can offer, ensuring that customers have access to cutting-edge financial solutions.

In conclusion, mobile and online banking has rapidly emerged as a powerful force in the financial sector, providing convenience, accessibility, and financial inclusion to millions of people. As technology advances and security measures improve, mobile banking will likely become even more integral to our daily financial lives. With fintech innovation at its core, online banking is reshaping the future of finance. However, as with any technological revolution, it’s essential to navigate the challenges carefully to ensure that mobile banking remains secure, inclusive, and accessible to all. Need expert guidance for your banking website and fintech strategies, contact us to learn more.