ADVIA CREDIT UNION

Services we provide:

- Discovery

- Digital Strategy

- Content Analysis

- Custom Integrations

- UX/UI Design

- Website Development

- Hosting

- Support

About Advia Credit Union

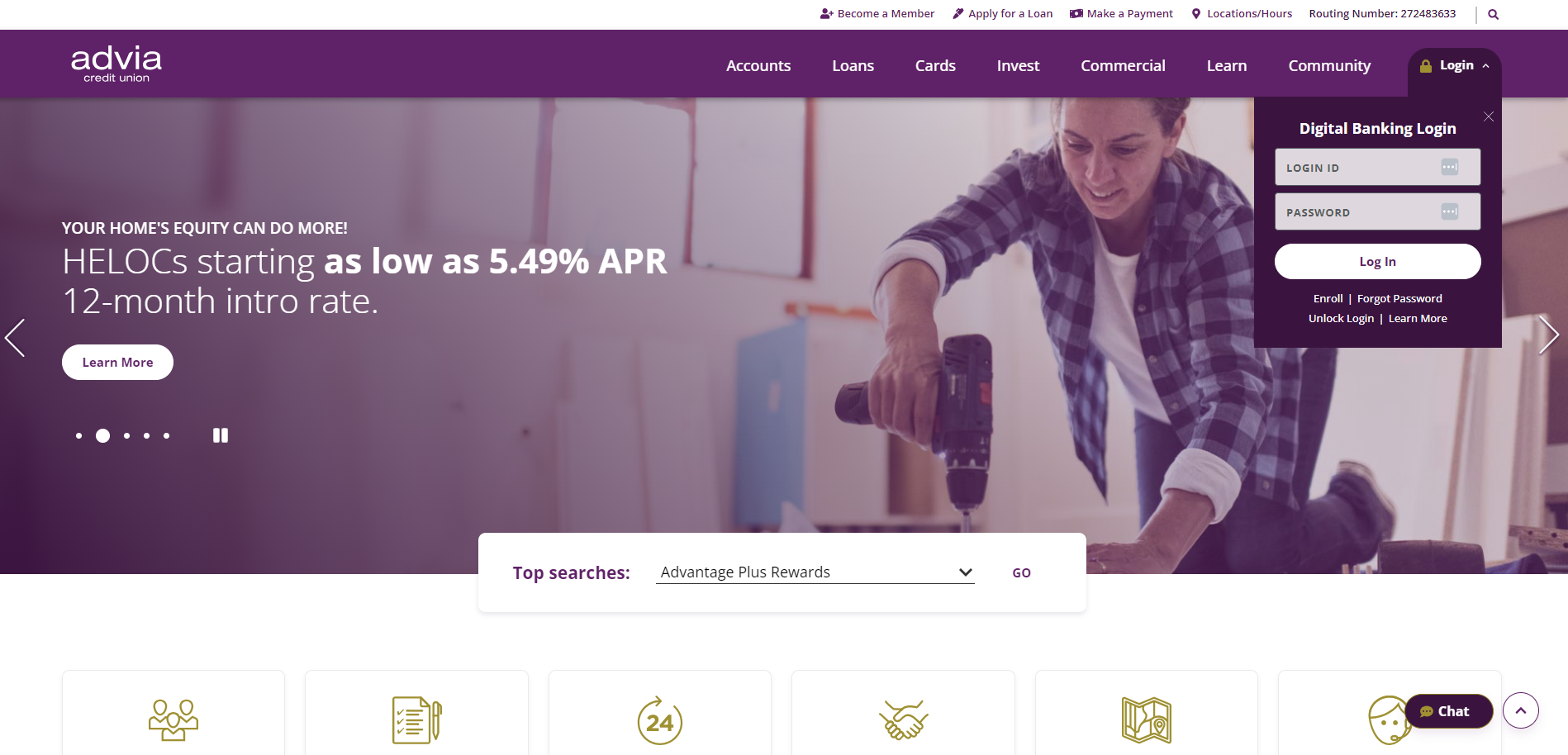

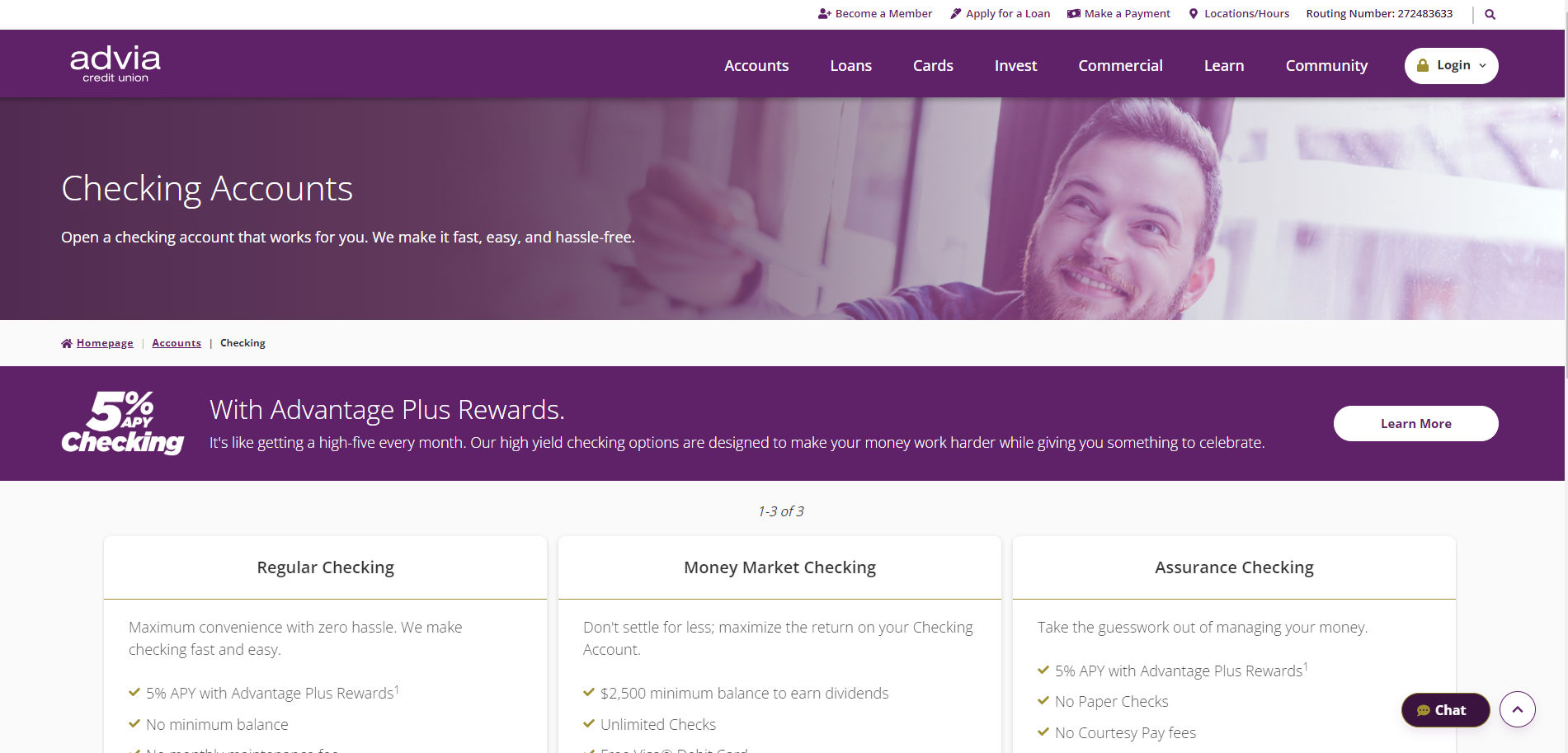

Advia Credit Union has a mission to provide financial advantages to its members by providing advice, advocating for members, and offering advantages other financial institutions don’t. This is accomplished through innovative financial solutions and a new, scalable website. For this new site, Advia sought to proactively provide the quickest and easiest digital solution for members to get the best user experience. Advia is not like other financial institutions; this is illustrated in Advia’s commitment to serving the ever-changing financial needs of its members. One of its core values is to drive progress by engaging in a spirit of innovation and developing new digital service tools for its members. This led to an innovative website redesign to give members easy access to information digitally.

The Challenge

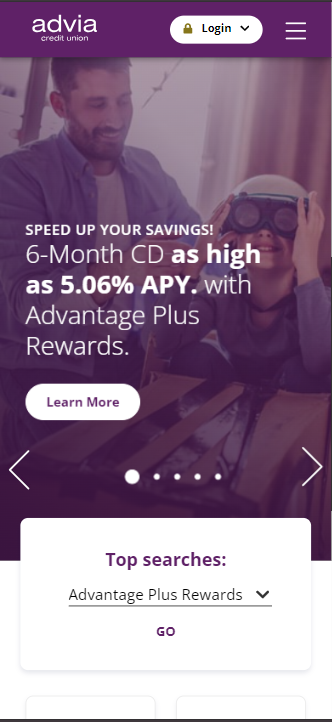

The old website was not intuitive, and the overall digital experience lacked. The lending areas of the old site for both mortgages and auto loans were not producing results. With increased in mobile traffic, the site needed an improved mobile user experience. A major challenge facing Advia’s business team was the organization and content hierarchy of the old site. The content was repetitive and text-heavy, and members were confused about where to find the information they sought. Other obstacles included Advia’s team being unable to easily update the content and structure of the pages on the old website.

Goals for the New Site:

- Improved navigation layout

- Measurable enhancements

- Increase time spent on the website

- Meets brand standards with redesign

- Increase overall visitors engagement

- Increase content management efficiency

Advia wanted to create a “one-stop” resource center to educate members on digital banking—including forms, links, documents, and video tutorials. Two goals for the new Advia Credit Union website were simplifying content and allowing self-service for members. Advia did not want to reinvent the wheel in terms of UI but wanted to deliver a better digital experience to its members and potential new members. The new website provides a clean and clear navigation experience to eliminate clutter and confusion.

The Right Platform

SilverTech reviewed several CMS/DX platforms with Advia. Progress Sitefinity was the chosen platform, giving Advia a fully optimized digital experience. Using the page templates on the Sitefinity platform allows Advia to accomplish the goals for the new site by enhancing the design and layout of the website with ease. The new website improves the user experience with the use of properly placed navigation buttons and call to actions (CTAs) clearly directing users through the content on the page to the sub-pages. Advia’s site has an engaging navigation and advanced filter functionality allowing users to get to the content they are looking for with ease. Additionally, the Advia content team can seamlessly update and create pages within the Sitefinity CMS, keeping the website current and relevant.

RESULTS

Helping Financial Institutions Find Better Tech Solutions

By: Emma Harris | 8/22/21

Not all solutions are created equal

A recent study from the American Bankers Association (ABA) discovered that financial institutions, specifically small to mid-sized banks, are becoming increasingly frustrated with their current tech stack. In an analysis of ABA’s findings, The Financial Brand explains that many financial institutions are caught between the legacy solutions, the well-established but expensive solutions, and the forward-thinking, niche start-up solutions that are offering the CX features customers now expect. There appears to be a trade-off of quality between customer experience and longevity when selecting a new platform.

How can financial institutions find affordable, customized, and future-proofed systems? A great place to start is working with a digital transformation expert. SilverTech has been in the digital space for 25 years, specifically helping financial institutions with a step-by-step approach that creates the ultimate digital customer experience with the least amount of frustration.

Start Small and Grow Incrementally

The first step is an internal audit. It is time to benchmark your starting point, learn the needs of your customers, and identify pain points and problem areas for your team and customers. Google analytics, your current CRM, and other tracking tools can provide key baseline data points. From here, you can review bounce rates, most successful CTAs, and current site optimization. The updates you can make in this step include testing new pieces of content and making changes to your layout design. During this process, it is important to pay special attention to your current platform’s capabilities. Is there room to grow to step two?

When your current system has been optimized and there are resources available to grow – it is time for step two. Step two requires the decision that financial institutions dread – choosing the right platform. If you have invested in a content management system (CMS) in the past few years and it isn’t performing, don’t assume you need a new one without understanding why it isn’t effective. Make your website as modern as possible. Include adequate help and tools to allow the customer to self-serve as they learn, compare, shop, and validate your company’s products and services. Again, make sure the mobile experience is a priority and consider other factors you will need to build in to continue building relationships with your customers. A modern website is interactive, lead-generating, and transactional. Other features of core solutions that you must be focusing on are listed below. How many items on this list can your current solution tackle?

- Communication and seamless integration with other customer-facing systems.

- Built-in automated workflows with approval processes for publishing new content.

- Modules-based design, rather than templated design.

- Lead scoring and persona segmentation.

- Personalization that caters the web experience to site visitors based on personas.

- Built-in marketing automation.

- Multi-lingual capabilities.

SilverTech ensures our partners have room to grow into personalization, automation, modules, etc. See our tech partners here.

Now that you understand audience needs and have overhauled your website to be modern and relevant, you are ready to begin implementing one-to-one experiences with your customers. Automation (lead scoring and predictive modeling), personalization, and integrating additional systems are the key components of this step. Here you can remain agile but pay attention to customer trends, test new features, and reevaluate your original KPIs to see your improvements.

Ongoing support may include the implementation of a digital marketing strategy, security fixes, and ensuring ADA compliance. It is important to work with a digital partner who has expertise in all these areas.

Consult with a digital expert

With the right guide, financial institutions will no longer need to be frustrated with their tech stack. In our many years working with financial institutions, have developed a step-by-step approach to digital transformation that meets any team, company, budget, or resource allowances.

Schedule a consultation to see where you can start.

Categories:

Financial Services