Community West Bank

Services we provide:

- Discovery

- Strategy

- UX/UI design

- Website development

- Xperience by Kentico implementation

About Community West Bank

CWB is a large community bank in southern California with over 20+ locations and a track record of financial strength, security and stability gained over its 44 years in business. CWB has set itself apart from other banks by its people, dedication to client advocacy, exemplary "relationship banking," strong community support and a mission to exceed expectations. With a passion for providing customized solutions, the merger drove the decision to revamp their digital services to better serve their customers.

The Process

In an era where digital presence is critical to financial institutions and mergers are frequent, the successful merger of Community West Bank (CWB) and Central Valley Bank (CVB) depended on a robust and well-executed digital strategy, critical to providing a seamless user experience for customers and employees. SilverTech, leveraging its expertise in Xperience by Kentico website development, customized a digital solution that unified the brands of these two banks into one cohesive user-friendly digital experience in just 4 months from start to launch.

The Challenges

The merger of CWB and CVB presented unique challenges, particularly in integrating two distinct digital landscapes into a single cohesive website. The biggest challenges included:

- Differing Content Strategies: CWB's site was optimized for SEO with a rich content library, while CVB's site focused more on detailed product pages. Balancing these different content approaches was crucial.

- Short Timeline: The project needed to be completed with a demanding timeline, delivering a high-quality, functional website, from planning to launch in less than four months.

- Outdated Technology: The old CWB site suffered from poor mobile optimization, slow speeds, outdated information, and a lack of interactive features. This hindered customer engagement and usability.

Goals for New Site

SilverTech identified four main goals for CWB's new website with the main goal of unifying the brands. The merger of the two banks presented a unique opportunity to take advantage of the best from both brands.

Solution and Implementation

Based on the insight gained, SilverTech devised a comprehensive strategy roadmap to address the challenges and deliver a seamless digital experience for the bank merger. It was SilverTech's recommendation that Kentico's newest hybrid CMS platform Xperience by Kentico would be the best solution for the new website. Xperience with robust features and functionality allowed SilverTech to create an exceptional digital user experience efficiently for CWB.

The Key components of the solution include:

- Unified Content Strategy: SilverTech developed a content migration plan that combined the SEO-rich content from CWB with the detailed product information from CVB. This approach ensured that the new site would benefit from both banks' strengths while avoiding duplication and inconsistencies.

- Modern Design and Functionality: The new website was built with Xperience by Kentico, featuring a modern, responsive design to enhance user experience across all devices. Key features included:

- Enhanced Interactivity: Interactive elements and engaging content to improve customer interaction and retention

- Improved CTAs: Clear, strategically placed CTAs to guide users through the site effectively

- Technical Upgrades: Faster loading speeds, improved reliability, and mobile optimization to ensure a smooth user experience

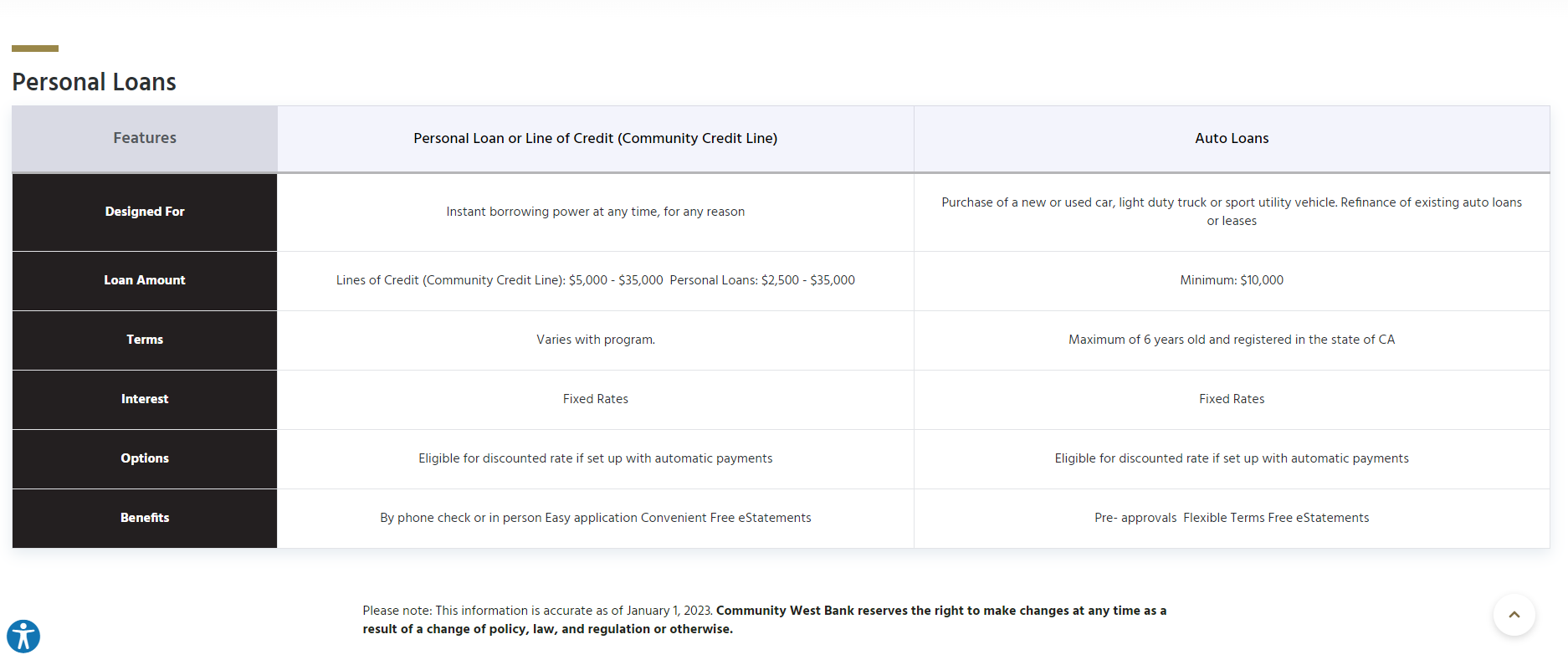

- New Functionalities: Inclusion of essential tools like product comparison tools, branch locator and more

- Accelerated Development Timeline: Despite the tight timeline, SilverTech employed agile development practices to ensure timely delivery without compromising quality. The team worked in sprints to continuously test and refine the site, leading up to a successful launch within the four-month timeframe.

HIGHLIGHTS

The Rise of Mobile and Online Banking

11/19/24

In the last decade, online banking has transformed from a niche service into a fundamental part of the global financial ecosystem. As smartphones have become ubiquitous, banking institutions have responded by developing innovative mobile applications that allow customers to manage their finances anytime, anywhere. The rise of mobile banking has reshaped the way people interact with their banks and revolutionized financial services worldwide. In a survey by MarketWatch 3 out of 4 people preferred their mobile app or online banking.

Growth Drivers of Mobile and Online Banking

Several factors have contributed to the exponential growth of mobile and online banking, making these the fastest-growing sectors in fintech:

1. Smartphone Penetration:

The rapid adoption of smartphones globally has provided the infrastructure needed for mobile banking to flourish. With smartphones becoming more affordable, even people in remote regions can now access financial services without the need for physical branches.

2. Convenience and Accessibility

The convenience of mobile and online banking is a major driver of its success. Customers can check balances, transfer funds, pay bills, and even apply for loans from their phones or on their computers, eliminating the need for visits to a bank branch. This level of accessibility is especially valuable for people with busy schedules or those living in areas far from banking institutions.

3. Increased Internet Access

Expanding internet access, particularly in developing regions, has further fueled mobile banking. As internet penetration grows, more individuals can access financial services online, contributing to the financial inclusion of previously underserved populations.

4. Digital Transformation of Banks

Financial institutions have embraced digital transformation to meet customer expectations. Banks now offer sophisticated mobile apps with secure features, including biometric authentication, personalized dashboards, and real-time updates. This allows users to manage their accounts with confidence, knowing their data is safe.

Security and Challenges

Despite its advantages, mobile and online banking faces challenges, particularly around cybersecurity. With the rise of digital services comes the risk of fraud, data breaches, and phishing attacks. Banks and fintech companies must invest in robust security measures, such as encryption and Multi-Factor Authentication (MFA), to safeguard customer information and build trust in mobile banking platforms. Banks need a digital partner that is an expert in fintech security.

The Future of Online and Mobile Banking

As technology continues to evolve, the future of mobile and online banking looks promising. With advances in artificial intelligence, machine learning, and blockchain technology, mobile banking apps will become even more personalized, efficient, and secure. Features like AI-driven financial advice, automated savings tools, and digital wallets are likely to become standard offerings in the years to come.

For traditional banks, the focus will likely shift toward creating hybrid experiences that combine the convenience of online banking with the personalized service of in-branch interactions. Furthermore, partnerships between traditional banks and fintech experts will continue to push the boundaries of what mobile and online banking can offer, ensuring that customers have access to cutting-edge financial solutions.

In conclusion, mobile and online banking has rapidly emerged as a powerful force in the financial sector, providing convenience, accessibility, and financial inclusion to millions of people. As technology advances and security measures improve, mobile banking will likely become even more integral to our daily financial lives. With fintech innovation at its core, online banking is reshaping the future of finance. However, as with any technological revolution, it’s essential to navigate the challenges carefully to ensure that mobile banking remains secure, inclusive, and accessible to all. Need expert guidance for your banking website and fintech strategies, contact us to learn more.